Coverages

James G Parker Insurance Associates offers various personal insurance solutions. Despite contrary belief, personal insurance is not limited to your home or automobile. Many other insurance policies cover a myriad of items or scenarios. Here are some of the most common personal lines policies and a brief breakdown of each.

Auto Insurance

Simply put, car insurance is an insurance policy for your vehicle. It covers any damage you are responsible for but can also cover any damage you may cause to your car. Most states require you to carry a minimum limit of liability. In California, the limits required are as follows:

- $15,000 per person or $30,000 per accident for bodily injury

- $5,000 property damage

These limits are often not enough, but they can be increased for an additional premium. You also have the option to add the following optional coverages:

- Uninsured Motorist Bodily Injury (UMBI)

- Uninsured Motorist Property Damage (UMPD)

- Medical Payments

- Collision

- Comprehensive

Comprehensive and collision coverages are typically referred to as physical damage coverage and may be required by your bank if you are financing or leasing your car.

Homeowners Insurance

Your mortgage company will require a homeowners policy if you are purchasing the home with a loan. But even if you are buying a home with cash, insurance is still a great idea. While there is coverage for the structure itself, a home policy will offer additional coverages. Some of these coverages include:

- Dwelling: This is coverage for the structure of the home and anything attached to it.

- Other Structures: Anything unattached to the home would be covered under other structures. Examples would be an unattached garage, gazebo, or shed.

- Personal Property: This is coverage for any personal property in your home. Personal property includes appliances, furniture, clothes, etc.

- Loss of Use: In the event of a loss to your home, you may be temporarily displaced. The loss of use coverage will pay your expenses to live elsewhere while your home is repaired or rebuilt.

Homeowners policies can also protect your jewelry, collectibles, artwork, and other valuable items, usually via an endorsement to the policy.

Renters Insurance

If you rent your home, a renters policy can offer the same protection as a homeowners policy with some slight differences. Coverage for the structure itself and any detached buildings is not needed and, therefore, not provided. The primary coverage instead is for your personal property. The loss of use, liability, and medical coverage seen in the home policy is also provided with a renter’s policy along with the option to cover your more valuable items through an endorsement.

Personal Liability Insurance

Homeowners and renters policies will also automatically provide personal liability coverage. This is usually divided into two separate coverages:

- Liability: This coverage will pay for any injury or property damage to those who do not live with you, for which you are legally responsible. Standard coverage starts at $100,000 with the option of higher limits.

- Medical: This coverage is similar to the liability coverage, except it covers medical expenses only, and the limits offered are not as high. Standard coverage usually starts at $1,000.

Landlord Insurance

Landlord insurance is the type of policy you would need to rent out a home you own. This policy provides similar coverage to a homeowners policy but protects against loss of rental income due to a covered loss.

Motorcycle Insurance

Coverage for your motorcycle can either be a separate policy or added onto your auto policy, depending on the insurance company. Either way, the coverage provided is very similar to the coverages provided on your car insurance. Motorcycle insurance will typically pay for any damage or bodily injury you cause, with the option to add coverage for your bike.

Recreational Vehicle Insurance

Recreational vehicles such as camper vans, 5th wheels, and travel trailers often require different coverage and, therefore, different insurance policies. While the coverage typically remains the same as an auto policy, you will have different needs. Companies may offer additional coverages such as personal property, vacation liability, or emergency expense coverage.

Boat Insurance

There is some coverage available through a homeowners or renters policy for watercraft, but it is very minimal. If you are looking for more extensive coverage, including liability for any damage your boat may cause, it is often best to purchase a boat policy. Coverage offered usually includes theft, passenger liability, and towing in addition to third-party liability and coverage for the boat itself.

Earthquake Insurance

Homeowners and renters policies do not typically cover damage from earthquakes. In California, if you would like to protect your home and belongings from earthquakes, you would need to obtain earthquake insurance. These policies provide coverage for both your home and personal property. Contact us for a quote.

Flood Insurance

Flood is another peril not offered through a homeowners or renters policy. If you live in a flood zone or are concerned about flooding, you need to purchase a separate flood policy.

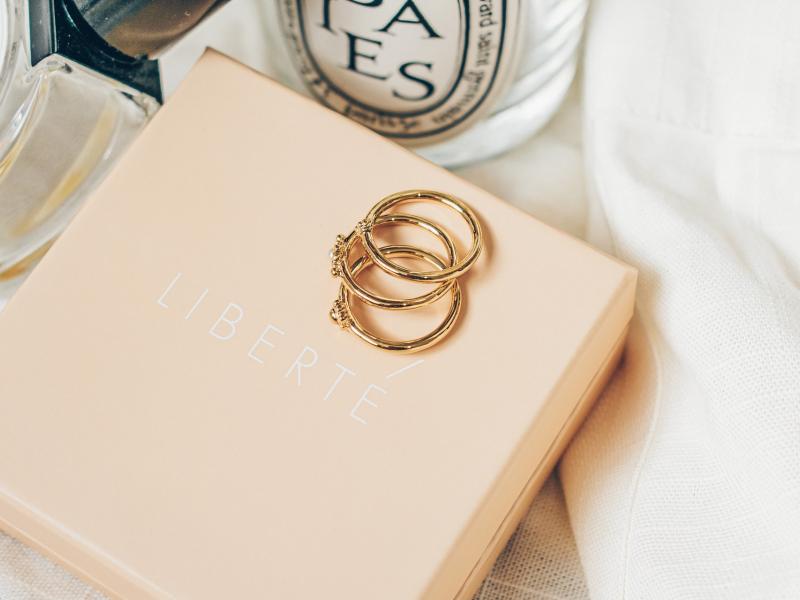

Jewelry Insurance

Jewelry is considered personal property and would be covered under your homeowners or renters policy. However, coverage is limited to the perils (or events) specified in the policy and usually only up to $1,500 when it comes to theft. You have the option to either schedule the jewelry on your homeowners or renters policy or purchase a separate policy to ensure your jewelry is covered for its value and a broader number of perils.

Vacation Homes

If you are fortunate enough to have a secondary or vacation home, you should ensure it is protected as well. Liability, in some cases, can be extended from your primary home policy to any other residences you own. However, you would need a separate policy to cover the structure of the home. Be sure to advise your insurance agent if you are renting out the home, as this can affect the type of coverage you need.

Identity Fraud

While homeowners and renters policies do not offer protection against identity fraud, they do frequently offer an endorsement you can add that will provide such services as bank fees, any legal expenses incurred, and lost wages, among others.

Identity fraud coverage is not automatically provided by most companies, however. Be sure to indicate you want this coverage added to your policies.

Umbrella Insurance

An umbrella policy provides extra liability protection above and beyond what your underlying personal insurance policies cover. For example, if you carry a $100,000 liability limit on your homeowners policy but experience a liability loss of $500,000, you would be responsible for the additional $400,000. An umbrella policy, if purchased, would cover the difference. Coverage usually starts at $1,000,000 and is relatively affordable. An umbrella policy is an excellent idea for individuals who own many assets they would like to protect.

Wedding & Special Events

It may be hard to believe, but you can also obtain personal insurance to cover weddings or any other special events you have! This coverage is especially important if you are serving alcohol at your event, where you may need additional liability coverage.

Do I need workers' compensation coverage for my gardener or my housekeeper?

No, they are not considered your employees if they do not work for you full-time and offer the same service to other customers. However, if you have a full-time nanny or housekeeper, check if workers’ compensation coverage is provided on your homeowners policy. Be sure to discuss this with your agent because you might need to purchase a separate policy.

Why should I buy insurance if I am already renting?

In the event of a natural disaster or catastrophe, renters insurance protects your possessions and helps with living expenses. What if a pipe bursts or a spark ignites a fire, destroying your personal possessions and forcing you to move to a motel temporarily? What if robbers break into your home and steal your belongings because your door is unlocked? Your homeowners policy will not cover your possessions. Can you afford to replace everything you own?

Is the jewelry I recently inherited from my grandmother covered if it's lost or stolen?

If your jewelry is stolen, your homeowners insurance can only provide limited coverage and may not cover mysterious disappearances. Check your policy for specific coverage limits. Typically, coverage does not exceed $500. Your jewelry must be scheduled and might require an appraisal in order to be covered for its full value. Any other priceless heirlooms will be treated in the same manner. Be sure to talk to your agent about any antiques, artwork, collections, and any other irreplaceable items.

Do I need to buy coverage for my unlicensed ATVs?

Because some ATVs are not licensed for the road, you might assume insurance coverage is not needed or required, but you may be wrong. There are a couple of things to keep in mind:

- ATVs have a high theft rate

- Homeowners insurance may not cover your ATV if you ride it off of your property or if you trailer it to another location

- ATV insurance is required in a state-owned or public park

- Even if your ATV is not licensed for road use, you are still liable should you or someone else driving your ATV cause an accident and someone is injured and/or has property damage

Can I get insurance for my wedding or the retirement party we are hosting for my dad?

Weddings and other special events are happy occasions that require a lot of planning and can put a strain on one's budget. Special event insurance can protect against the unexpected by allowing you to recoup some of your expenses if:

- Venue declares bankruptcy and goes out of business just before the big day, resulting in the loss of the deposit

- Attire purchased or rented for the honorees is lost or stolen

- Alcohol-related lawsuits occur as a result of intoxicated guests

- Gifts are damaged while on display at the event

- Photographer's photos are lost or damaged

- Bands or DJs are a no-show and the deposit is lost

- Food or damaged cake causes sickness or can’t be served because it's spoiled

- Event is postponed due to family illnesses, untimely deaths, or travel delays

Do I need identity fraud coverage?

Yes, identity theft is the fastest-growing white-collar crime in America. No one is immune to identity fraud. The process of restoring your good name, financial and medical history, and creditworthiness can be time-consuming and costly.

Each client has unique and pressing needs. We offer broad coverage that can ensure your success, whether you're an individual mitigating risk or a business looking to grow.

Our representatives can inform you of the tools you need to succeed:

- Standard coverages and custom solutions

- Ongoing support and consulting services

- Streamlined process for moving through the claims process

Reach out to us today.